raleigh nc sales tax calculator

65 100 0065. Look up 2022 sales tax rates for Raleigh North Carolina and surrounding areas.

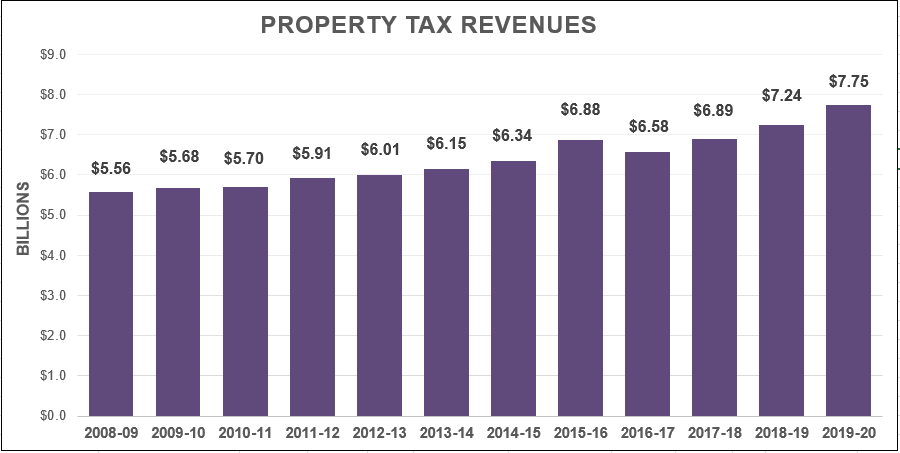

County Budget And Tax Survey North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

Real property tax on median home.

. The December 2020 total local sales tax rate was also 7250. Our calculator has recently been updated to include both the latest Federal. 54 rows The sales tax rate ranges from 0 to 16 depending on the state and the type of good or service and all states differ in their enforcement of sales tax.

The North Carolina NC state sales tax rate is currently 475. Ad Calculate Your 2022 Tax Return 100. County and local taxes in most areas bring the sales.

The current total local sales tax rate in Raleigh NC is 7250. Calculate North Carolina Sales Tax Example. 690Average Local State Sales Tax.

Maximum Possible Sales Tax. General Sales and Use Tax. North Carolina has not always had a flat income tax rate though.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Raleigh NC Sales Tax Rate. Depending on local municipalities the total tax rate can be as high as 75.

Easily E-File to Claim Your Max Refund Guaranteed. Divide tax percentage by 100. It is not.

Tax rates are provided by Avalara and updated monthly. Who Should Register for Sales and Use Tax. 111 S King Charles Rd.

Maximum Local Sales Tax. This includes the rates on the state county city and special. In Durham and Orange counties specifically there is an additional 05 tax which is used to fund the Research Triangle Regional Public Transportation Authority.

US Sales Tax calculator North Carolina. The latest sales tax rates for cities starting with R in North Carolina NC state. Overview of Sales and Use Taxes.

Skip to main content. List price is 90 and tax percentage is 65. The average cumulative sales tax rate in Raleigh North Carolina is 726 with a range that spans from 725 to 75.

Multiply price by decimal. North Carolina State Sales Tax. The price of the coffee maker is 70 and your state sales tax is 65.

Ramseur NC Sales Tax Rate. Rates include state. Know what your tax refund will be with FreeTaxUSAs free tax return calculator.

The information included on this website is to be used only as a guide. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations. The base sales tax in North Carolina is 475You can also use Sales Tax calculator at the front page where you can fill in percentages by yourself.

Jackson Hewitt provides year-round support to hard-working clients with innovative. Sales and Use Tax Sales and Use Tax. Sales Tax 30000 - 8000.

Average Local State Sales Tax. Sales and Use Tax. In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes.

North Carolina has a 475 statewide sales tax rate. You are able to use our North Carolina State Tax Calculator to calculate your total tax costs in the tax year 202223. Sales Tax State Local Sales Tax on Food.

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

North Carolina Vehicle Sales Tax Fees Calculator Find The Best Car Price

How High Is Georgia S Corporate Tax Rate Atlanta Business Chronicle

Cost Of Living Apex Nc Official Website

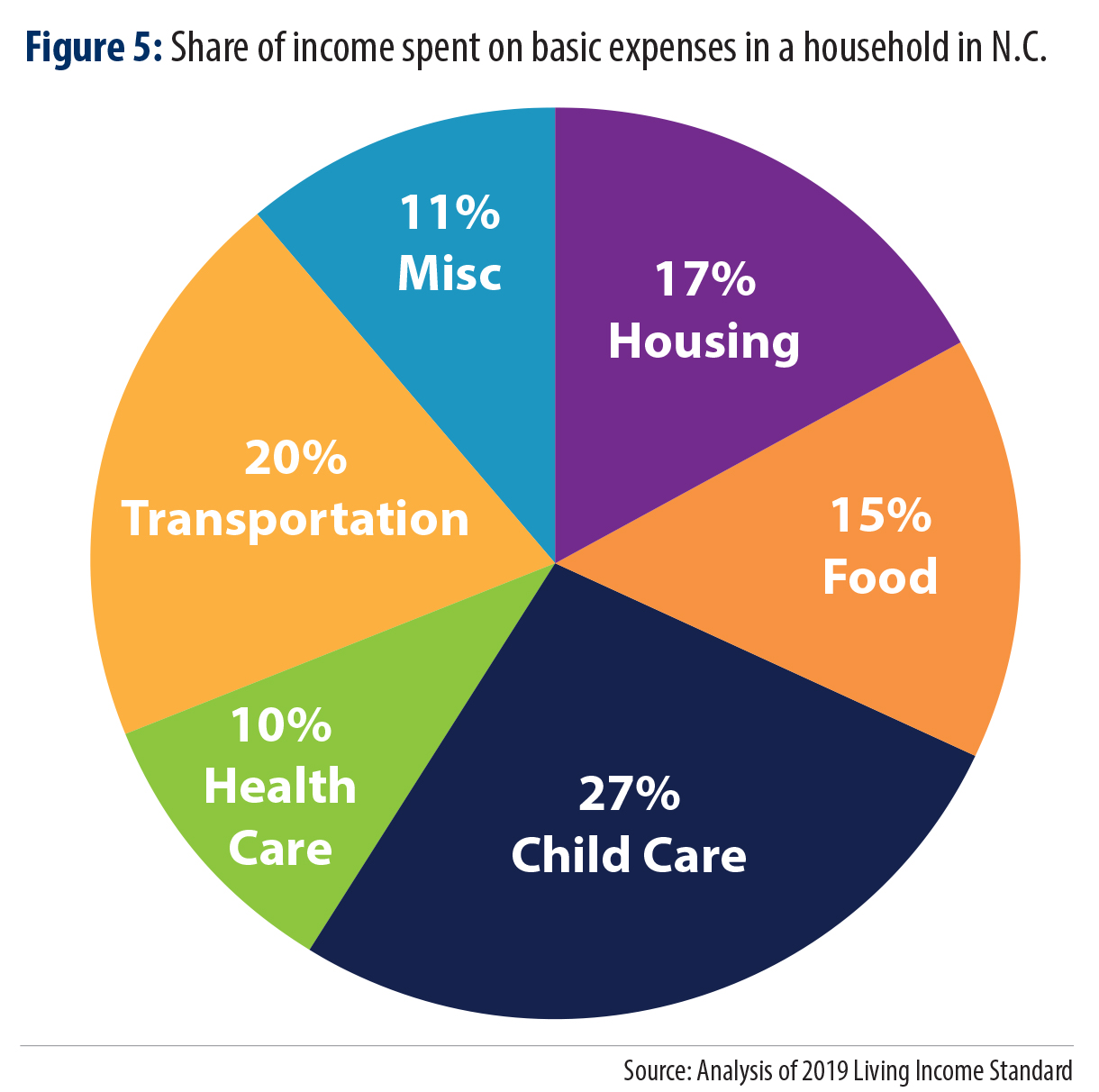

The 2019 Living Income Standard For 100 Counties North Carolina Justice Center

Why Doesn T North Carolina Have A Tax Free Weekend Wcnc Com

North Carolina Sales Tax Calculator Reverse Sales Dremployee

N C Property Tax Relief Helping Families Without Harming Communities North Carolina Justice Center

North Carolina Income Tax Calculator Smartasset

Cost Of Living In Charlotte Nc Is Charlotte Affordable Data Tips Info

Is Shipping Taxable In North Carolina Taxjar

County Budget And Tax Survey North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

The Ultimate Guide To North Carolina Real Estate Taxes

Economy In Raleigh North Carolina

North Carolina Tax Reform Options A Guide To Fair Simple Pro Growth Reform Tax Foundation

Raleigh Tax Controversy Attorney Tax Attorney In Raleigh Nc Louis Wooten Attorney At Law

Sales And Use Tax Division North Carolina Department Of Revenue